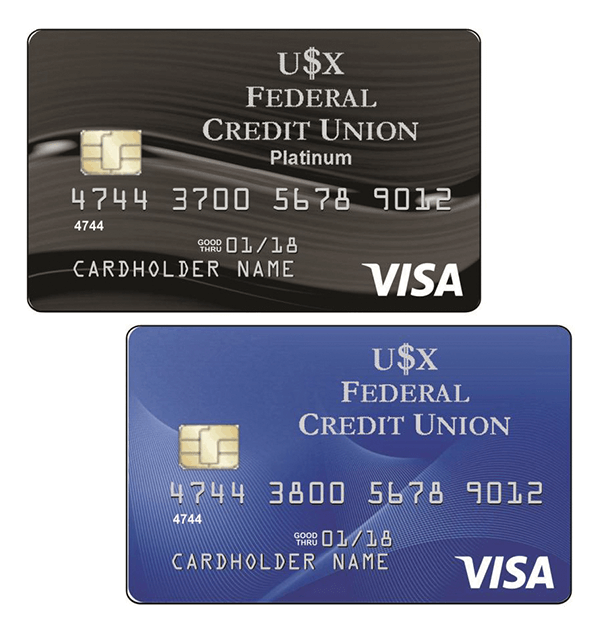

Apply for a USX FCU Visa® credit card and get a low, fixed rate plus:

Fixed rates as low as

9.90% APR*

*APR = Annual Percentage Rate. Rates will vary from 9.90% APR to 15.90% APR for the Visa®️ Platinum Card and 17.90% APR for the Visa®️ Blue card. Rate will be determined by overall creditworthiness. Visa®️ Blue card carries a $50.00 annual fee. Not all will qualify. See credit union for details.

APPLY TODAY

HOME EQUITY LINE OF CREDIT

6-month initial rate as low as

0.99% APR*

variable interest rate thereafter

*APR = Annual Percentage Rate. 0.99% Introductory APR offer available for new lines of credit only for the first six (6) months from closing date. These rates are adjusted on a quarterly basis and are indexed to Prime Rate as published in The Wall Street Journal (WSJ). Adjusted rate effective October 1, 2020, based on The Wall Street Journal Prime Rate (3.25%) as of September 20, 2020, in accordance with loan term. Maximum rate adjustment is 2% in a calendar year. Rate cannot go below 4.00%. Minimum Real Estate secured loan amount $10,000. Property must be owner occupied and primary residence, geographical restrictions may apply. All loan approvals are subject to normal loan underwriting guidelines. Offer expires March 31, 2021. Programs, rates and conditions are subject to change at any time. **USX FCU pays all closing costs ranging from $100 to $1,500. See local credit union office for all details.

Happy Holidays from all of us here at your credit union!

It is hard to believe that 2020 is rapidly coming to a close. This past year has been a year like no other and it appears that the effects of the COVID-19 pandemic will be with us well into 2021.

Throughout the year, we have taken many actions to protect our employees and members. There have been times when we closed our offices to lobby traffic and used drive thru only for member transactions. When our offices were open for lobby traffic, we required masks for employees and members. We limited the number of people in our lobbies so that we could be compliant with social distancing requirements. In addition to these actions, our employees that were housed in one physical location prior to the pandemic were moved into multiple locations within our organization. We also have several employees working from home. In addition, we upgraded our drive thru lanes at our Cranberry Township office in order to provide better service to our members. All of these actions were taken so that we could provide a safe operating environment for our employees and our members. We apologize for any inconvenience that these actions may have caused.

Remember that no matter the COVID-19 environment, you can always take advantage of our many FREE electronic and online delivery services:

Through these channels, you can check balances, transfer funds, deposit checks, pay bills and apply for loans. If you are not enrolled in these services, visit our website www.usxfcu.org or call us at 1-888-219-3159 for assistance. Please remember that USX FCU is your credit union and that we are here to help and support you with your financial needs. Please reach out to us for any assistance we may be able to provide. Call 1-888-219-3159 or email: info@usxfcu.org.

Again, Happy Holidays and thank you for your membership in USX Federal Credit Union!

Be well and be safe.

Mark A. Volponi, President/CEO

The Board of Directors and Staff would like to welcome the following new companies, associations and their employees or members to USX FCU:

Full Canopy, LLC

Remember if your co-workers are not yet members of USX FCU, you can get paid for introducing them to the credit union. Ask our staff how.

Due to the lingering effects of the COVID-19 pandemic. The location, date and time of the 82nd annual meeting will be determined at a later date. We will provide information to the membership when the details have been confirmed.

Notice is hereby given that three Directors will be elected to the USX Federal Credit Union Board of Directors at the 2020 Annual Meeting. The following three people have been nominated for election by the Nominating Committee:

John E. ( Jack) Toth – Mr. Toth retired from US Steel Corporation in 1999 after more than 36 years of service holding various positions in the Accounting, Metallurgical and Logistic Services Departments. He served in the Army Reserves from 1963 to 1969 and Honorably Discharged as SGT E-5. He is a graduate of Robert Morris JR. College and the University of Pittsburgh. He has been actively involved with our credit union for over 47 years. His involvement began in 1973 as a member of the Supervisory (Auditing) Committee. He was chairman of that committee for 18 years, elected to the Board of Directors in 1982, serving as Vice President for 10 years and has served our members as Board Chairman for the past 24 years. He serves on various committees and represents our credit union as a member of NACUC, the National Association of Credit Union Chairman and was the recipient of the prestigious National Association of Credit Union Chairman’s Leadership Award in 2017.

James D. Settelmaier – Mr. Settelmaier has served as a volunteer of the USX Federal Credit Union since 2001. In 2005 he was appointed to the Board of Directors where he has served on the Supervisory, Human Resources, Asset Liability and Membership committees. Mr. Settelmaier is a graduate of Saint Vincent College, and received an MBA from Point Park University. Mr. Settelmaier was employed by U S Steel Corporation for 20 years where he worked in Cash & Banking, Audit and Internal Controls.

Christopher D. Panian – Mr. Panian is the Commercial Accounts Manager for Central Electric Cooperative, Parker, Pennsylvania. Mr. Panian has worked in the electric utility business for 29 years holding various positions with electric utilities and related businesses. Mr. Panian holds a BA degree from the University of Pittsburgh and has been associated with the board of directors as an Associate Director and Director since 2007. Additional nominations for election to the Board were solicited from the membership in the Fall 2020 issue of the newsletter USXtra. No additional nominations have been received. Accordingly, election of the nominees will be affirmed at the meeting. No nominations will be accepted from the floor during the Annual Meeting.

Mashawn A. Lorenz, Secretary

December 20, 2020

USX Federal Credit Union is required to report Unclaimed Property (escheat) to the Pennsylvania and Ohio Department of Revenue for accounts that have been “dormant” in accordance with state law. An account is considered dormant if there have been no member initiated withdrawals, deposits or transfers made during this period. The best way to be safe is to WAKE UP your account by making a deposit and watching your USX FCU accounts grow. If you are unsure of the status of your account, please contact your local office by calling 1-888-219-3159.

USX FCU is currently in the process of a much needed redesigning of our website. The new site will have an exciting new look, updated design and enhanced navigation. Please watch for our “Live Date” information on our current website and in branch notices.

USX Federal Credit Union® is working hard to help you protect yourself! By offering CardTrac a card management and fraud mitigation tool for debit and credit cardholders. Cardholders simply download the FREE app from the Apple® App Store or Google® Play Store, and then you can actively manage your USX FCU debit and credit cards.

The on/off feature is only one of the safeguards available with CardTrac. Using the GPS system in the smart phone, geographic use restrictions can be established. Other controls can restrict usage by merchant and spending limit. Real time alerts create another layer of fraud protection with notice that a transaction was attempted, declined, or both.

NEW FEATURE: CardTrac Travel Plans* (for Debit Card Only)

When planning to travel, use the travel plan feature to alert USX FCU and our debit card security team that you’ll be traveling so that your debit card will be available for use during your trip without receiving a telephone call from our card fraud department asking if you made a purchase outside of your home area.

We anticipate the travel plans feature to be available on your USX FCU VISA credit cards in 2021.

CardTrac puts the control of debit and credit cards right into the cardholders’ hands. Link more than one account to keep track of all debit and credit cards in one easy-to-use application.

For more information, visit our website, our local office or contact USX Federal Credit Union at 888-219-3159.

*To utilize the Travel Plan feature, USX FCU must have your current cellphone number to receive your security verification code.

The following credit union chapters will be offering various student member scholarships for 2021.

Scholarship requirements:

NOTE: Other requirements for each individual scholarship offer are listed and explained on the respective application.

To receive the application information for the student scholarships please contact Tim Wojtaszek via email tcwojtaszek@usxfcu.org.

Focus on your overall approach during times of short-term volatility.

– Provided by Nathan Rodgers

As an investor, it can be tempting to get caught up in daily news headlines. Consider how news about the election and COVID-19 vaccines have moved the markets over the past several weeks. But having a financial strategy can help you ignore short-term volatility and focus on your long-term vision.

As you know, investing is a process based on your goals, time horizon, and risk tolerance. Interestingly enough, it’s also a process that may help you prepare for life’s financial challenges.

For example, did you know that only 44 percent of workers have estimated how much income they would need in retirement? What’s more, only 36 percent have calculated how much money they would need to cover healthcare expenses.1

Creating a financial strategy means thinking about the bigger picture, including a variety of issues like monthly income needs, handling unexpected expenses, and preparing for healthcare costs. People who take a “do-it-yourself ” approach can quickly find themselves overwhelmed by all the variables they need to consider.

If a current event or headline has caused you to reconsider your financial strategy, please give us a call. Sometimes, a newsworthy event can require a new approach. But many times, it may just be a “speed bump,” a momentary blip that’s already factored into your long-term vision.

Nathan Rodgers may be reached at 724.779.4895 or 888.219.3159 ext. 4895.

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.

Representatives are registered, securities sold, advisory services offered through CUNA Brokerage Services, Inc. (CBSI), member FINRA/SIPC , a registered broker/dealer and investment advisor, which is not an affiliate of the credit union. CBSI is under contract with the financial institution to make securities available to members. Not NCUA/NCUSIF/ FDIC insured, May Lose Value, No Financial Institution Guarantee. Not a deposit of any financial institution. If emailed, you must also add: Important message: the information contained in this message or any attached document is confidential and intended only for individuals to whom it is addressed. If you got this message in error, please inform me immediately. I may ask you to return the documents at my expense. In general, please simply destroy the information at once. Any unauthorized use, distribution, or copying of this information is prohibited. Citations 1. EBRI.org, April 23, 2020

*APR = Annual Percentage Rate. Introductory balance transfer rate of 1.99% APR is valid January 2, 2021 – March 31, 2021. Promotional rate expires on September 30, 2021. 1.99% APR is valid on balance transfers only and does not apply to new purchases or cash advances. Following promotional period, rates will vary from 9.90% APR to 15.90% APR for the Visa®️ Platinum Card and 17.90% APR for the Visa®️ Blue card. Rate will be determined by overall creditworthiness. Visa®️ Blue card carries a $50.00 annual fee. Not all will qualify. See credit union for details.

USXFCU provides links to web sites of other organizations in order to provide visitors with certain information. A link does not constitute an endorsement of content, viewpoint, policies, products or services of that web site. Once you link to another web site not maintained by USXFCU, you are subject to the terms and conditions of that web site, including but not limited to its privacy policy.

Click the link above to continue or CANCEL