Buying a car is a significant financial commitment, and it’s essential to approach the process with careful consideration to ensure you get the best deal possible. Whether you’re purchasing a new or used vehicle, making smart decisions will save you money and reduce stress in the long run. At USX FCU, we’re ready to guide you through the process and help you make an informed decision that works best for you and your budget.

1. Set Your Budget and Stick to It

Before you even step onto a dealership lot, it’s crucial to know what you can afford. Establish a budget based on your financial situation, taking into account not only the car’s price but also additional costs like taxes, insurance, registration, and ongoing maintenance. Consider these percentages:

- 20% down payment

- 10% of your monthly income for the car payment (including insurance and gas)

Remember a car’s value will decrease over time. Putting down a decent down payment will help keep you from drowning in payments while keeping your equity balanced.

2. Weigh Your Options

Gone are the days of relying solely on dealership brochures or recommendations from friends. Thanks to the internet, you have access to a wealth of information. Start by researching different makes and models to understand what suits your needs and lifestyle. Consider factors like:

- Fuel efficiency

- Safety ratings

- Reliability

- Resale value

- Warranty coverage

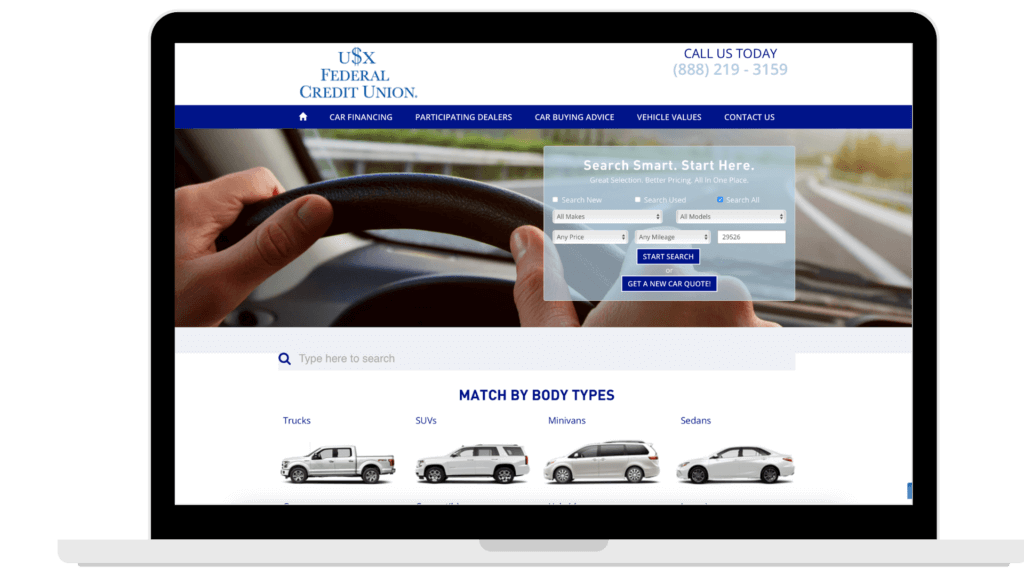

Now, with the USX FCU Member Auto Center it’s easier than ever before to find your next car.

Browse cars by year, make, model, and more from the comfort of home!

4. Get Pre-approved for a Loan

One of the smartest moves you can make before heading to the dealership is securing financing. By getting pre-approved for an auto loan you’ll:

- Know your interest rate and loan terms

- Have a clear budget for your car purchase

- Be in a stronger position when negotiating with the dealership

5. Understand the Total Cost of Ownership

While the sticker price is the most obvious number, the total cost of ownership over the life of the car matters just as much. Consider:

- Fuel costs (some cars are much more fuel-efficient than others)

- Insurance premiums (these can vary significantly by make and model)

- Maintenance and repair costs (luxury cars tend to be more expensive to maintain)

- Depreciation (how well the car holds its value over time)

Factor these ongoing costs into your overall budget.

Remember, buying a car is a big decision, and it’s not something that should be rushed. Don’t let a salesperson pressure you into making a snap decision. Take your time to evaluate your options and make sure you feel comfortable with the car, the price, and the financing.

Shopping for a car doesn’t have to be overwhelming if you approach it with a plan. By doing your research, securing pre-approved financing, and taking your time to evaluate your options, you can find the right car that fits your budget and lifestyle. At USX FCU, we’re here to support you every step of the way with competitive rates and resources to make your car-buying experience as smooth as possible.

Ready to get started? Contact us today to learn more about our auto loan options and start shopping smart!